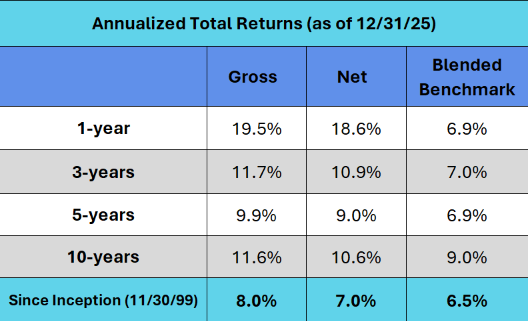

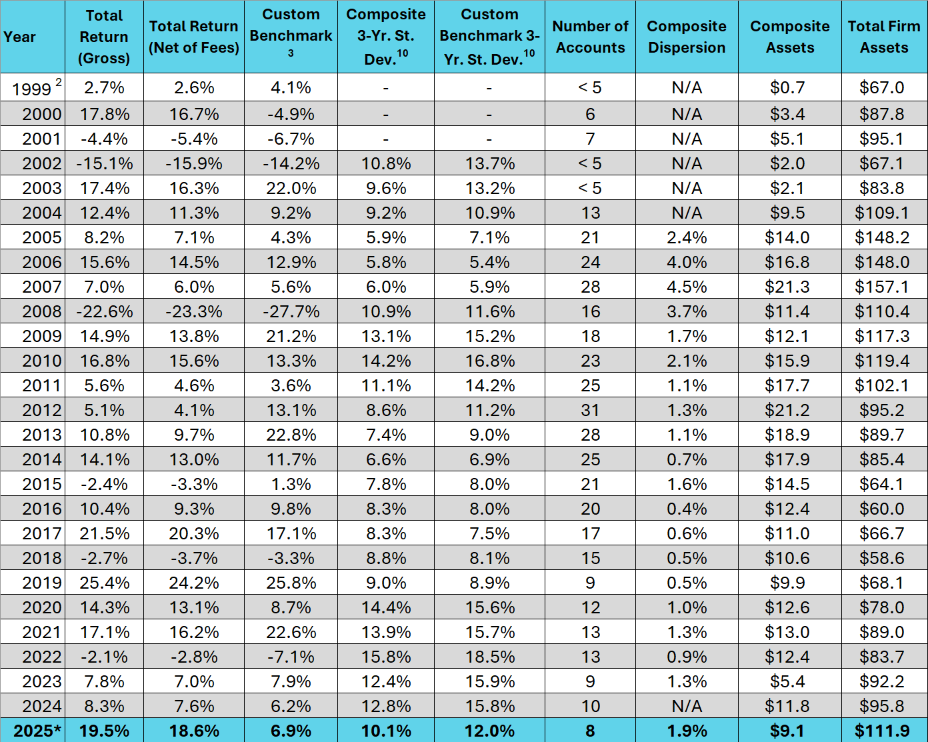

Leeb Capital Management Income & Growth Composite Global Investment Performance Standards Report

December 1, 1999, through December 31, 2025*

Results from January 1, 2025, to December 31, 2025, have not yet been verified by an independent verifier.

Past performance is not indicative of future returns. For more information on the performance and additional disclosures, please contact Scott Chan at schan@leeb.com

Leeb Capital Management (“LCM”) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared this report in compliance with the GIPS Standards. LCM has been independently verified for the periods 4/1/99 through 12/31/24. The verification report(s) is/are available upon request.

A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report.

Notes:

1.) Leeb Capital Management (“LCM”) is a registered investment advisor with the Securities and Exchange Commission. Prior to 2001, the firm was doing business as Money Growth Institute. LCM provides equity money management to retail and institutional investors. LCM’s Income & Growth Composite (“Composite”) represents all fee-paying accounts with assets greater than $250,000 that are managed in accordance with LCM’s Income & Growth investment strategy. LCM’s Income & Growth Composite combines income generating securities, including common equity, preferred stocks, convertible bonds, and fixed income investments. Portfolios are managed to generate current income and with the objective of preserving capital. Portfolios are subject to modest security turnover. Objectives of the portfolio are to minimize inflation risk through current income, credit risk by focusing the majority of holdings in investment grade securities and market risk by diversifying between various income sectors i.e. REITs, utilities and preferred stocks. The composite contains both taxable and tax-sheltered portfolios.

2.) The Composite was created on November 30, 1999 which coincides with the inception of this strategy. A complete list of composite descriptions is available upon request. For the periods from April 1, 1999 through September 30, 2007, LCM was verified by Ashland Partners and Company LLP. For the period October 1, 2007 through December 31, 2016, LCM was verified by ACA Performance Services, LLC. From 2017 through 2024, LCM was verified by The Spaulding Group. A copy of the verification report is available upon request. Additional information regarding the firm’s policies and procedures for valuing portfolios, calculating and reporting performance results as well as preparing GIPS reports are available upon request.

3.) The composite returns are compared to a custom blended benchmark. Before 1/1/20, this static custom blended benchmark consisted of 75% the S&P 500 Index and 25% Bond Index. From inception through 6/30/08, the DJ Lehman Bond Index was the bond index used. This benchmark was discontinued in 3Q08 due to uncertainty about the future of the benchmark after Lehman Brothers declared bankruptcy. LCM replaced it with the ML US Corporate, Government, & Mortgage Bond Index. From composite inception, SPDR S&P 500 ETF (SPY) has been used as proxy for the S&P 500 Index. Starting 1/1/20, the blended benchmark was changed to 90% ProShares S&P 500 Dividend Aristocrats ETF (NOBL), an ETF that tracks the S&P 500 Dividend Aristocrats Index, and 10% ML US Corporate, Government & Mortgage Bond Index. An ETF was chosen because an index is not tradeable and LCM believes that an ETF more accurately reflects the actual return an investor could achieve.

Benchmarks are selected based upon similarity to the investment style of our composites and accepted norms within the industry. The benchmark is rebalanced monthly.

4.) Valuations are computed and performance is reported in U.S. dollars.

5.) Composite returns are presented gross and net. Gross returns are presented gross of fees (net of only transaction costs) and includes reinvestment of dividend and income when applicable. Net return reduces the gross return by investment advisory fees. From composite inception through December 31, 2020, the net return was calculated using the highest management clients in accordance with LCM’s Income & Growth strategy fee schedule: 1.0% flat fee based on AUM. To calculate the net return, the composite’s gross return each month was reduced by 1/12 of the 1% annual fee. Accounts in the composite do not pay a commission on trades of most U.S.-listed securities. Beginning in January 2021, the net fee calculation uses the actual fee paid by accounts in the composite

6.) Annual rates of return for the portfolio are computed by compounding the monthly rates of return over the applicable number of months.

7.) LCM utilizes neither leverage nor derivative instruments as a material component of its investment strategies.

8.) From composite inception through December 31, 2017, composite dispersion was calculated using the asset-weighted standard deviation of all portfolios that were included in the composite for the entire year. From January 1, 2018 through December 31, 2024, composite dispersion is calculated using the equally-weighted standard deviation of all portfolios that were included in the composite for the entire year. Dispersion is calculated gross of fees. N/A – Information is not statistically significant due to an insufficient number of portfolios in the composite for the entire year.

9.) LCM defines a significant cash flow as an external flow of cash or securities (capital additions or withdrawals) that is client initiated. An external flow of at least 10% of the portfolio market value is considered significant. This policy became effective July 1, 2002

10.) The 3-year annualized standard deviation measures variability of the (gross) composite and the benchmark returns over the preceding 36-month period.

11.) Actual performance of client accounts may differ substantially.

12.) Past performance is not indicative of future results.

13.) The Benchmark Returns are not covered by the report of independent verifiers.

14.) GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

The content presented in this document is for informational purposes and should not be taken as a recommendation to purchase any individual securities. Index returns shown in the performance comparisons where provided by Standard & Poor’s, Dow Jones, Lehman Brothers, Merrill Lynch, YCharts, and Orion Advisor. All of this information comes from sources believed by LCM to be reliable. LCM, however, cannot guarantee the accuracy of the comparative returns and therefore shall not be held liable for inaccurate information obtained from data providers.

Dr. Stephen Leeb serves as the President, Research Chairman, and Chief Compliance Officer of Leeb Capital Management, an SEC-registered investment advisory firm. He has authored nine books on various economic and investment topics. In addition, he serves as the Editor of Turbulent Time Investor (“TTI”), an online newsletter focused on investing. TTI is published by TCI Enterprises, LLC, a separate company also owned by Dr. Leeb. The recommendations in the newsletter are general investment opinions and recommendations, not individual investment advice and should not be construed as personalized investment advice. This activity is separate and distinct from the investment advisory services of LCM. LCM does not manage client portfolios based on the strategies or recommendations included in the newsletters. LCM’s clients can, however, acquire securities that are recommended in a publication. LCM, at all times, strives to act in the best interest of clients and to treat all clients in a fair and equitable manner. When trading securities of companies that are discussed/recommended in the newsletters to which LCM employees contribute content, in keeping with its fiduciary duty owed to advisory clients, LCM will transact in the securities prior to the release of the newsletters. Noting that the investment parameters of newsletter subscribers may differ from those of LCM’s clients, it is possible that LCM may act on behalf of LCM’s clients in a manner contrary to the recommendations provided in the newsletter subscribers. Nothing on this website should be constructed as a solicitation or offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction. LCM does not render or offer to render personal investment advice or financial planning advice through our website. Viewing or utilizing information on this website, or contacting or responding to our offices or investment adviser representatives does not create an investment advisory relationship of any kind. An investment advisory relationship can only be established and investment advice can only be provided after the following three events have been completed: (1) LCM’s thorough review with you of all the relevant facts pertaining to a potential engagement; (2) the execution of a written LCM engagement and fee agreement; and (3) delivery of the LCM Form ADV disclosure brochure. For more information, please see our ADV.