How To Build An Investment Portfolio For Inflation Conditions

The trend for the next decade is expected to be faster economic growth in emerging economies along with higher inflation. To avoid any potential losses, it may be wise to start building an investment portfolio for inflation risk offset; such as real assets. Meanwhile, reducing holdings of financial assets such as stocks and bonds that are more subjective to inflationary pressures.

This article focuses on constructing an investment portfolio for inflation conditions, including those suitable for income investors who may be vulnerable to losses during inflationary periods. We consider these investments to be viable during times of high inflation because they possess one or more of the following three strengths:

- Their values are tied to the price of a real asset in some way.

- They have historically benefited significantly from faster economic growth.

- They have the potential to outgrow inflation.

These strengths enable certain financial instruments to beat inflation in all but the most extreme economic conditions.

Historical Inflation References

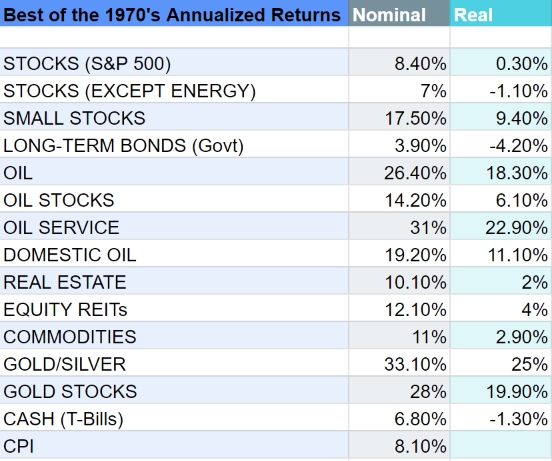

While history never repeats itself exactly, it can serve as our best guide to consider what happened during the last high inflation period in the United States economy. The graph we have created below, titled “Best of the ’70s,” compares the performance of various sectors and asset classes, including bank savings accounts, long-term bonds, and overall stock market performance during the high inflation decade of the 1970s.

Similar to recent times, the 1970s were characterized by relatively rapid economic growth, which was interrupted by a sharp decline early in the decade. Inflation soared into double digits following the Arab oil embargo of 1974, and again after the overthrow of the Shah of Iran in 1978.

Bonds performed poorly during a specific period, losing over 4% annually in comparison to inflation that was running at a high rate of 8.1%. Similarly, stocks and cash excluding energy shares also lost over 1% annually. However, some investment sectors and asset classes did manage to beat inflation by a significant margin. For instance, gold and silver averaged a 33/1 percent annual gain that beat inflation by 25 percentage points per year during the 1970s. Oil service company stocks also outperformed inflation by 22.9%. Moreover, small stocks rolled up an average annual return of 17.5%, beating inflation by 9.4%.

Inflation Has Already Infiltrated The Global Economy

While you cannot precisely predict the return rate of any asset class, diversifying your portfolio with some picks from the best-performing groups can position you well. The answer to how you should fit these inflation plays into your portfolio and how drastically you should act depends on your own preferences and financial goals. Conservative players should stick with safer inflation plays while more aggressive investors should focus on higher-risk and higher-reward choices.

It is important to note that long-term trends take years to reach fruition. Although commodity prices have awakened from their decade-long lull, investing in commodities today doesn’t guarantee overnight gains. Therefore, it is crucial to take incremental action now. Creating an investment portfolio for inflation risk offset is imminently important to avoid the need for drastic changes in the future.

To start, limit your exposure to investments that generated real returns close to zero or negative. For example, money market returns did not keep up with inflation during the 1970s and are unlikely to do so now. Additionally, begin adding the plays that performed better during the 1970s. This era demonstrates how easy it was to generate greater returns, provided you invested in the right assets.

Investors have the liberty to make their investment decisions, but it is essential to consider historical data and research to make the best course of action regarding individualized investment objectives. For instance, mutual fund investors might want to consider shifting their stock holdings from large-cap diversified funds to top-quality choices specializing in small stocks. Those who are focused on growth should consider diversifying their portfolio to include holdings in commodities. Income investors might swap some long-term bonds for inflation-beating income generators like equity REITs and big oil stocks. Finally, those concerned about capital preservation can find safe haven in gold and other precious metals.

Three Building Blocks of Inflation

Inflation’s three building blocks are high economic growth in emerging economies, commodity and resource shortages/scarcity, and the monetary/debt overhang money supply explosion. With these building blocks already in place, it’s only a matter of time before they trigger the third building block. The timing could take several months or several years, but the outcome will be the same. Therefore, it is crucial to ensure that your investment portfolio is adjusting in the right direction, and most or all of your holdings can ultimately beat inflation, whether they’re income or growth plays.

Inflation is slowly starting to infiltrate, and it will be some time before the three building blocks of inflation reach full force. However, investors should not wait too long to act. Rising commodity prices, the mandate for faster economic growth globally in emerging economies, and America’s huge monetary and debt overhang have a firm foundation. Once inflation becomes unavoidably obvious to all, inflation-beating investments will no longer be bargains. To conclude, it’s time to prepare now.

Get In Touch

Our investment professionals understand that building a wealth management strategy can be overwhelming. Start by scheduling a no-obligation investment consultation with a registered investment adviser representative.