Small Cap Stock Investing Tips

Since the mid-1920s to mid-1990s, history has proven that the most minuscule 20% of NYSE stocks have chalked up an average annual return of 12.2%. By contrast, large stocks, as measured by the S&P 400 industrials, averaged only 10.2%.

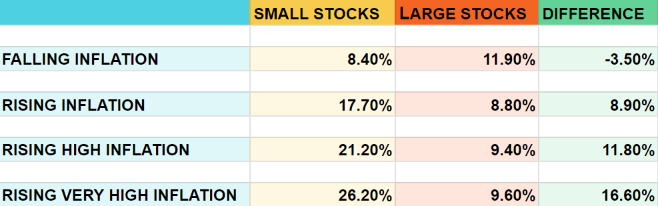

As our table shows, small cap stock investing has performed much better when inflation has increased. Since 1926, small stocks have led the way whenever the CPI has risen over five years. And when the CPI was growing at a 5% clip or higher, the tally was small stocks at 21.2% a year and extensive stocks only tallying 9.4%.

CPI growth of over 7% widened the gap even more, when investing in small cap stocks posting gains three times larger than the big boys.

Why does small cap stock investing typically do so well during rising inflation?

Simply because on average they have more growth potential and entail more risk than big stocks. They perform best when investors are focusing more on growth and less on risk.

When economic growth is blasting ahead, inflation is typically rising. Investors’ paramount concern at such times is keeping up with inflation. When investing in small cap stocks, their earnings can grow much faster when inflation rises than when it’s low or falling. For one thing, faster inflation causes market conditions to be less competitive. Protecting and gaining market share becomes less critical than generating higher sales. There’s enough to go around for both the small and large to profit.

When competition isn’t so intense, it’s far easier for a $100 million dollar company to double its revenue than it is for a multibillion-dollar company to do so.

In other words, even if they don’t take market share from the big boys, the small stocks will add sales. The smaller the company, the less of an increase it will take to generate a higher percentage gain.

Small stocks’ close relationship with inflation makes them an excellent inflation hedge. In fact, history shows that, except when inflation is flying, small cap stock investing has been, on occasion, a more lucrative investment than gold, the quintessential inflation hedge.

The price of gold was deregulated in the early 1970s when then-President Nixon took the world off the gold standard. Consequently, we only have records of free-market gold prices for the past 50 years. But since the early 1970s, whenever CPI inflation has been at least 7% and rising, gold and other precious metals have averaged a return of about 16% per year. That’s far less than small stocks’ average annual return of 21.2% gain during that period.

Sharing is caring, folks! Feel free to share this article with a friend or fellow investor!

Get In Touch

Our investment professionals understand that building a wealth management strategy can be overwhelming. Start by scheduling a no-obligation investment consultation with a registered investment adviser representative.