What Does Inflation Mean For Today’s Investors?

Over the long haul, inflation is the prime mover of investment markets. When Hard Assets Rise, Financial Assets Fall…

When inflation is falling, financial assets like stocks and bonds thrive.

Therefore, historically, hard assets like gold, oil, and real estate take over when inflation rises.

Inflation was low and well-behaved from the early 1980s to the mid-1990s. As a result, stocks and bonds gained ground.

This means that during times of rising inflation (such as what we are experiencing now), buying and holding a basket of stocks, bonds, and diversified mutual funds could be a formula for potential financial loss.

It’s indisputable that stocks and bonds have made money over the long term. Unfortunately, there have been plenty of uncomfortably long periods when it has paid to be on the sidelines.

Those who bought at the top of the market in 1929 (for example) took nearly 20 years to make back what they lost during the great Stock Market Crash. Although not nearly as dramatic or catastrophic, the early 1990s was similar.

During the 1980s to early 1990s, central banks focused on fighting inflation. Wall Street prospered under low inflation and stable economic growth.

In sharp contrast, the current economic climate is similar to the 1970s… Which was a decade of rapid inflation and uneven growth. This boded disastrous for stocks and bonds.

Inflation ahead means the latter 2020s could follow the same historical pattern as the 1970s. After all, history does tend to repeat itself.

What will be the investments of choice in the years ahead?

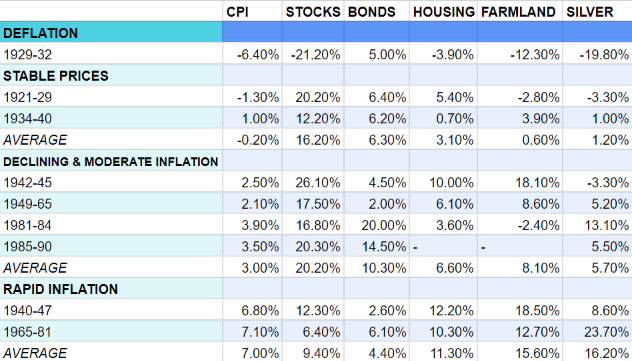

To explain the best possible roadmap ahead, we created a historical graph called “Annual Rates of Return” based on data gathered from 1929 to the early 1990’s.

The detailed graph shows how various investments have historically performed at different inflation levels. Incidentally, the data speaks volumes about the cyclical nature of the stock market and how inflation throws both caveats and windfalls into the mix.

As the graph highlights, times were markedly worse during the 1966 – 1974. That nearly decade stretch shows that most stocks did not generate positive nominal returns.

Moreover, there was also a hefty price to pay for not making any moves at all. The gut-wrenching volatility of the period, including the historic sell-off of 1973 – 1974, caused many large blue-chip stocks to lose more than half of their value in a devastating decline.

Bonds were undoubtedly no picnic either. Like Fed rates today, top-quality bond yields rose from 4% to 5% during the mid-1960s.

Fast forward, interest rates skyrocketed to an alarming 15% in the early 1980s under (then Fed chair) Volker. Bondholders who hung on until their bonds matured received their full principal but suffered an enormous loss of purchasing power.

The road to riches does not run through financial assets such as stocks and bonds in a world of rapidly rising inflation.

Investment Roadmap for the Next Decade

Poor returns for stocks as a group doesn’t necessarily mean that every stock will flop. Nor does it suggest losses for every fixed-income investment. We’re convinced that if you do your research, you will be able to find companies that have the potential to score gains in an otherwise desultory financial environment.

Let us also be clear: not every real or ‘hard’ asset will be a guaranteed winner over the long term. There will be plenty of ways to lose money in bad real estate, gold, or energy stocks, for that matter.

The economic times ahead will be a time of staggering opportunities for those who know how to recognize them. Higher inflation does not necessarily mean economic catastrophe. It could prove to be quite the opposite. Although now more than ever, timing will become far more essential to success. Hard assets like real estate and gold may trade places with financial assets as the portfolio picks of choice because they are a store of wealth during market volatility. Regardless, this will be an age of opportunity, but the options will be considerably different as we are amidst unprecedented times.

Wrap Up

Ultimately, every investor must weigh the pros and cons before making investment decisions. This article presents empirical, historical data revealing which investment sectors performed well during times of inflation. We suggest that every investor consider the history and current economic conditions while executing due diligence regarding their investment portfolio.

We hope this article was both educational and insightful. Sharing is caring. Please, feel free to share this article with a friend or fellow investor!