No matter how thoroughly you research a company before you buy its stock, bad things can happen out of the blue...

How To Diversify Your Investment Portfolio- Spread Out Your Bets

The reasoning is simple enough. If you put your proverbial eggs in multiple baskets, even if one or two baskets drop on the floor, the rest of your eggs would still be okay…

In real-world investing terms, learning how to diversify your investment portfolio is multi-faceted—investing in not just multiple stocks but multiple sectors and even multiple assets. For example, many financial advisors recommend using the standard 60/40 stock/bond split. I can’t entirely agree with that split because I think that unless an investor is super conservative, they are better off investing in stocks instead of bonds in the long run, but the 60/40 rule of thumb is still in use today.

Understanding how to diversify your investment portfolio can also help you make better decisions, especially if you need help keeping emotion out of your investment decisions.

The benefits of diversification in your portfolio should be self-evident. No matter how thoroughly you research a company before you buy its stock, bad things can happen out of the blue.

If a big chunk of your money is tied up in one stock, it will be hard not to get caught up in emotion and possibly make an impulsive decision you regret later. But if you’re only wagering, say, no more than 3% or 4% in any one stock, you’ll be more likely to make rational decisions and even sleep better at night.

Exchange-traded funds (ETFs) provide an easy way for investors to diversify. Instead of trying to pick a winner from a group of appealing companies, an investor can make a macro bet on the whole industry. Buying ETFs that track different sectors and assets is an alternative way to instantly diversify your investment portfolio. It’s possible to bet on the entire investable universe with a few dozen ETFs.

Getting the Bad with the Good

When implementing the basics of how to diversify your investment portfolio, spreading out your bets will limit your downside, but it will also limit your upside. For instance, when you buy an ETF, you get the bad with the good. Sometimes, you may be better off buying shares in a select few companies than investing in the whole industry because not all companies in the same industry are the same or similar. For example, let’s take a step back to 2020, when the outbreak of Covid-19 caused widespread social distancing mandates and lockdowns. Real estate investment trusts (REITs) were slammed because most REITs lease properties to businesses that suffer a significant revenue slowdown due to social distancing mandates.

As a result, investors fear that REITs won’t be able to collect rent from tenants. However, at that time, if you had invested in cell tower REITs such as Castle Crown (NYSE: CCI) or American Tower (NYSE: AMT) and not a REIT ETF, you would have dodged a bullet.

Cell towers need no human patrons to make money. People staying at home still consume wireless data. Indeed, cellular usage surged during the stay-at-home order as businesses and individuals remained connected virtually.

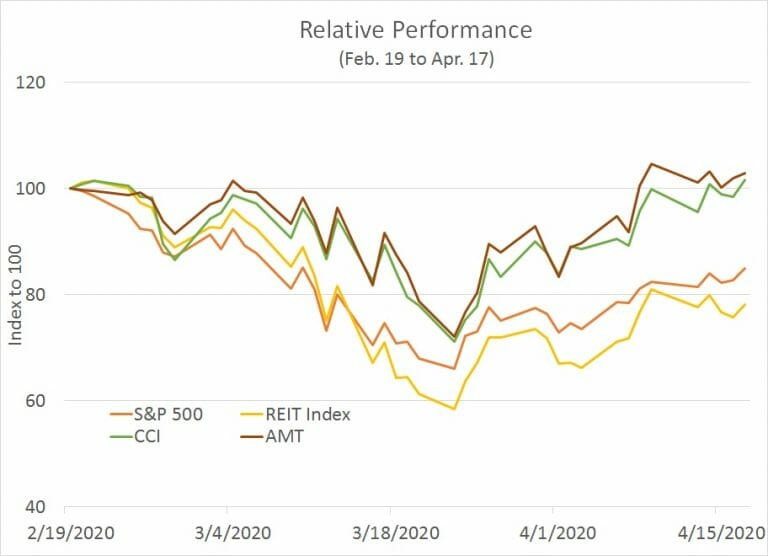

The chart shows the relative performance of CCI and AMT against the S&P 500 and a Vanguard REIT ETF from February 19, 2020 (the market peak in early 2020) through April 17, 2020. Both CCI and AMT showed impressive protection against the coronavirus. While the S&P 500 fell about 15% over that period, both CCI and AMT were slightly in the green.

To be clear, lately, CCI and AMT have not performed well due to inflation, and telecom companies (cell tower REITs’ customers) have been struggling under tight monetary conditions. However, despite the change in business conditions, the example of cell tower REITs being resistant to the pandemic outbreak still stands.

Pick the Best

While it’s easy to buy ETFs and call yourself diversified, often it’s preferable to diversify by investing in the best companies in each industry. The second approach certainly takes more research, but it’s a worthwhile effort.

Get In Touch

Leeb Capital Management offers no-obligation consultations with an investment professional.