How To Invest In Annuities

It’s natural for a person’s investment goals to change over his or her lifetime. When young, you want growth, also known as capital appreciation. After you purchase an investment, you want its price to go up as much as possible. You can afford to take some risks because you still have many working years ahead to generate income. Obviously, no one wants to lose money, but even if you did lose money, you still have time to recover. For example, as scary as the Financial Crisis and the Covid-19 market crashes were, people who stayed in the market likely have made back their money and then a lot more.

However, as you age and approach (or enter) retirement, you don’t have as much time left to earn income, so your risk tolerance decreases. As a result, your biggest investment goal may be to preserve what you already have. You can less afford to take big risks in pursuit of greater gains. After all, a few big mistakes could crack the nest egg that you spent years building up.

We believe that the stock market is still the best place for capital appreciation, but for very conservative investors who are happy with the savings they already have and don’t mind locking up their cash for at least several years, annuities have been a popular choice.

When you invest in annuities, you are signing a contract with an insurance company. You either pay the insurance company a lump sum upfront or you pay in installments. In return, the company will pay you cash either immediately or after an agreed amount of time. The insurance company invests the money it receives from you in something else and hopes to generate a higher return than it owes you. The difference is the insurance company’s profit.

Let’s take a look at the three main ways to invest in annuities:

- Fixed Annuity

- Variable Annuity

- Combination Annuity

There are also different ways to pay for the annuity: immediate or deferred.

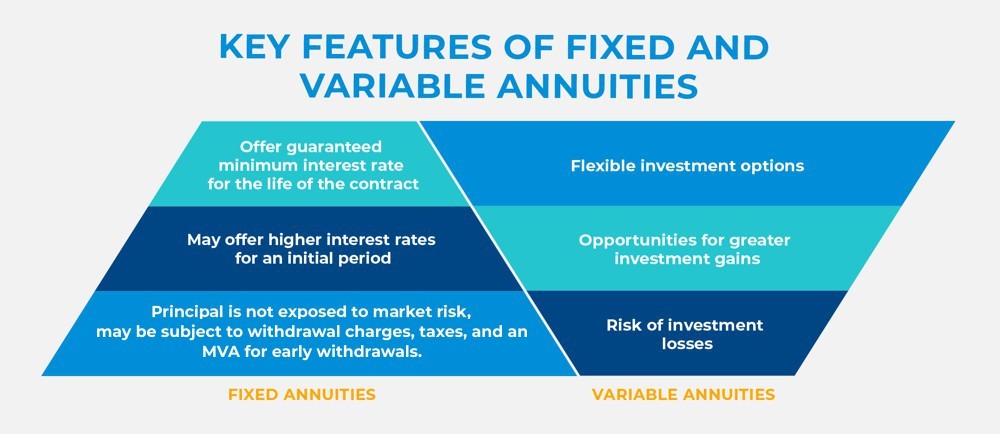

Fixed Annuity

A fixed annuity is the most straight-forward type of annuity. You receive a guaranteed rate of return each year, starting whenever the agreement says it will. However, note that often after a specified period of time, the insurance company can change the interest rate or a yearly or multi-yearly basis, but not below a guaranteed minimum fixed rate of return. So beware that although the introductory rate may look attractive, the rate could be lower later in the agreement. Review the agreement carefully before you sign.

Still, because the return is guaranteed, there’s no risk of loss in nominal value for you. If the insurance company’s investment portfolio generates a lower return than it guarantees you per the agreement, then the insurance company pays you the difference out of its own pocket.

A key potential downside to a fixed annuity is that since it may have fixed payments, if inflation rises, you would end up losing purchasing power and could even suffer a negative real return. For example, if you earn 4% from your annuity, but the inflation rate is 6%, then your real return would be -2%.

Variable Annuity

A variable annuity offers the potential for a higher return. This type of annuity does not guarantee a rate of return. Instead, the return is based on how the insurance company’s investment portfolio performs. The insurance company will typically offer you a list of investment options to choose from. You can pick the one that you feel offers the most sensible risk/reward balance for you.

The potential upside here is greater than that of a fixed annuity, but the potential drawback is that you could suffer a loss. Plus, variable annuities typically have more fees than a fixed annuity because investment portfolios for variable annuities are more actively managed and the folks managing them have to get paid. Some variable annuities come with other bells and whistles, but those will come with additional fees.

One such extra feature is the guaranteed death benefit. This means that if you happen to pass away during the accumulation phase of a deferred payment annuity, the annuity will pay your beneficiary (or beneficiaries) a specified minimum payment. Thus, at least your loved ones will at least get something if the worst happens. But it comes at a cost. Yup, more fees.

Combination Annuity

A hybrid or combination annuity is a combination of two or more annuities: a fixed annuity contract and a variable annuity contract that are both placed in the same annuity product. Its design allows a portion of an investor’s money to be placed in a mutual fund sub-account, which is the variable component.

So why would anyone buy a variable annuity? Part of the reason is that when you invest in annuities, it comes with tax deferral benefits.

Get In Touch

Our investment professionals understand that building a wealth management strategy can be overwhelming. Start by scheduling a no-obligation investment consultation with a registered investment adviser representative.