Investment Adviser

In selecting equity securities for the Peak Resources & Energy (PREP) Portfolio, Leeb Capital Management Investment Adviser starts by reviewing U.S. and foreign companies engaged in the natural resources industry, including those listed on the S&P Global Energy indices or the S&P Alternative Energy indices, the Philadelphia Gold & Silver Index, energy and natural resources sector ETFs and ETNs, ETFs and ETNs linked to commodities such as gold, silver, oil or agricultural products, or a commodity index; and companies engaged in alternative energy or conservation-related activities. This universe of over 1,000 companies is screened for market capitalization greater than $250 million, a projected Price/Earnings to Growth (“PEG”) ratio less than the S&P 500 Index, and a high free-cash-flow yield.

Upon the Investment Committee's discretion, LCM will select companies that do not meet the screening requirement. For example, LCM may invest in junior miners that own significant precious metals assets that it judges to have above-market growth potential. Due to the nature of small companies, they may not meet some or all of the aforementioned requirements.

The PEG is an indicator of a stock’s potential value. A lower PEG means the stock is more undervalued. The Adviser further reduces the resulting watch list of approximately 50 to 75 companies, using a rigorous fundamental research process described below to select about 30-40 equity securities for the portfolio. However, the Portfolio Managers have the discretion to select stocks that we believe offer extraordinary potential upside even if they do not meet one or more of the cited criteria. The Adviser’s analysis focuses on the following factors:

Once investments are identified, the portfolio is constructed under general weighting guidelines. These include but are not limited to:

LCM may invest in ETFs or ETNs linked to commodities such as gold, silver, oil, agricultural products, or a commodity index. A typical commodity-related ETF or ETN may seek economic exposure to commodity prices through direct investment in a commodity, such as gold bullion, or by investing in the securities of issuers primarily engaged in the production of specific commodities. The Adviser’s research suggests that commodity-related investments offer the potential for inflation protection, capital appreciation, and returns that are not highly correlated to equity markets. In a typical commodity-related ETF or ETN, the net asset value of the ETF is linked to the value of an individual commodity or the performance of commodity indices. Commodity ETFs and ETNs may use derivatives that expose them to further risks, including counterparty risk (i.e., the risk that the institution on the other side of the trade will default).

LCM may sell portfolio securities if our Portfolio Managers have determined specific securities have become over-priced or have suffered price depreciation. In this event, the securities sold can be advantageously replaced with other securities that offer a better risk/reward opportunity. Lastly, a security may be sold if changes affect a company’s fundamentals, making future growth prospects appear weak.

From time to time, our Portfolio Managers may take temporary defensive positions inconsistent with the portfolio’s principal investment strategies to respond to adverse market, economic, political, or other conditions. For example, portfolios may hold cash, money market mutual funds, investment grade short-term money market instruments, U.S. Government and agency securities (including zero coupon bonds), commercial paper, certificates of deposit, repurchase agreements, and other cash equivalents.

In addition to its three active investment strategies, LCM manages a limited number of advisory client accounts mainly invested in mutual funds. LCM designs this mutual fund strategy based on its screening process utilizing Morningstar data when selecting funds; portfolio composition is based on target sector weights according to LCM’s philosophy and client objectives. The mutual fund portfolios may be constructed with no-load funds, front-end load funds, back-end load funds, or contingent-deferred load funds. Such load fees, if any, are paid from the client’s accounts in addition to LCM’s advisory fees. Additionally, managers of mutual funds charge management fees that are exclusive of those set by LCM to its clients.

The world’s emerging economies, notably China, India, Brazil, Russia, and others, are overtaking the world’s developed nations in terms of total GDP. This represents a significant structural shift as their continued growth will require tremendous energy and resources. Driven by the needs of the developing parts of the world, we see global energy demand outstripping supply. Further, global energy production is increasingly hindered by diminishing returns as harder-to-procure resources close in on the point of parity between energy invested and energy returned.

Meanwhile, more meaningful investment must be put towards alternative energies, moving us closer to a catastrophic outcome. A war-like effort is required to combat this – including tens of billions of dollars in research and hundreds of billions of dollars in infrastructure in the U.S. alone.

However, energy is not an isolated commodity as other resources are interconnected, including base and precious metals, as well as other materials in great demand from developing and developed nations alike. Rising global populations are similarly putting strain on food supplies, driving higher costs for fertilizers, and sopping up limited clean water supplies. These forces push prices higher and combined with historical levels of monetary expansion; we believe that exceptional levels of inflation are imminent.

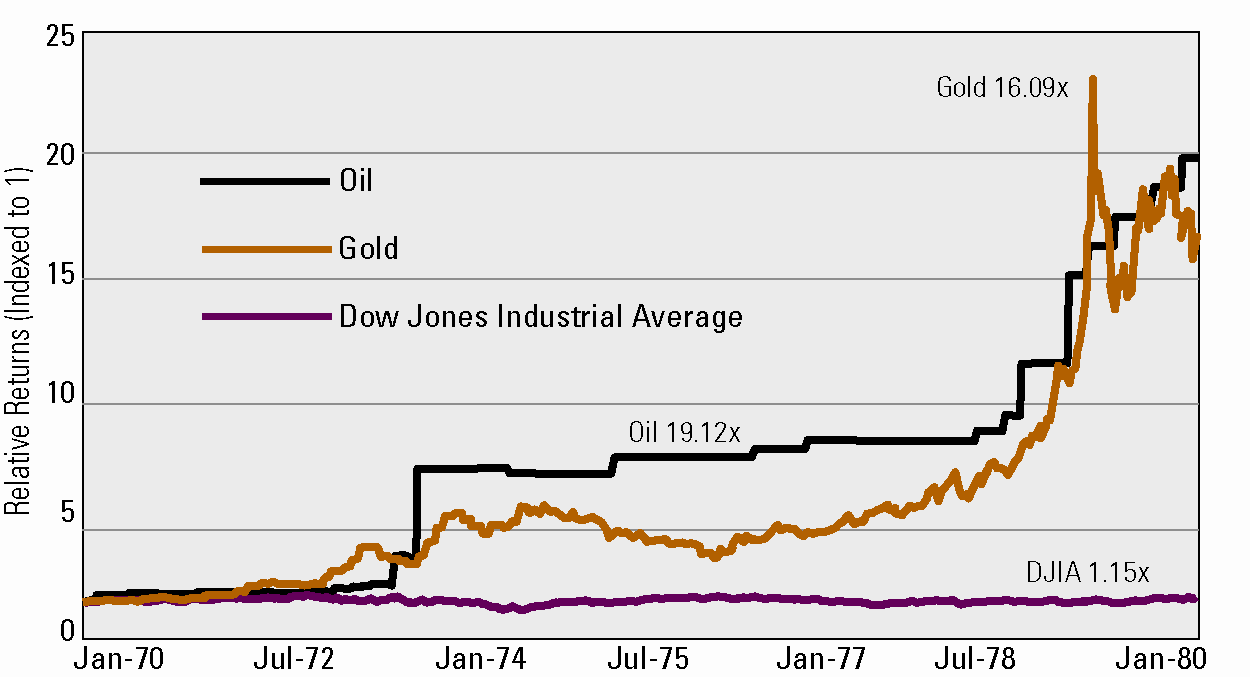

History Lesson: Select Hard Assets vs. Stocks in the 1970s

Consider the lesson we learned in the 1970s. Sharply rising energy costs led to stagflation: high unemployment, high inflation, and economic recession. As the chart below shows, oil and gold drastically outperformed U.S. large-cap stocks, as represented by the Dow Jones Industrial Average.

This time around, however, the situation could be better. Prices for resources are high courtesy of razor-thin margins between supply and rising demand rather than because of political forces in the 1970s. Further, navigating the worst economic climate seen in the country since the Depression has involved a historic expansion of the Federal Reserve balance sheet and significant funding from the U.S. Treasury. As the dollar depreciates and inflation soars, demand will increase for stores of value, namely, hard assets.

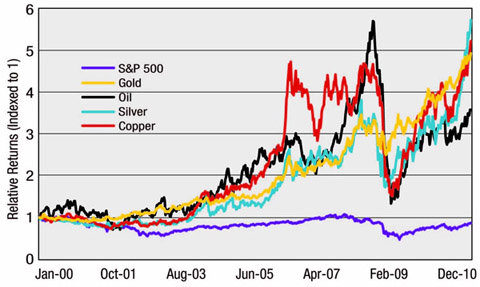

Surprisingly, this phenomenon is nothing new. The chart above displays a vivid key aspect of the behavior of the financial markets in the 2000s—while likely foreshadowing what lies ahead. It shows how sharply hard assets (including gold, oil, silver, and copper) and financial assets have diverged during the past decade. Silver outperformed the stock market by almost fivefold, while even oil outperformed by more than twofold.

This massive divergence may signify the end of an era, not a portent of things to come. Noting similar trends in the 1970s, culminating in an even more significant variation by 1980. That period was the high watermark for tangible assets relative to financial ones. This rationale ignores the most striking thing about the current departure: It has occurred with no burst of inflation.

The closest thing to an exception occurred in mid-2008 when inflation reached about 5% and was quickly followed by the most significant deflationary scare since the Depression. By contrast, in the 1970s, the vast gap between tangible and financial assets reflected historically high inflation rates. In 1980, the primary and perhaps only mission of the Federal Reserve was to stamp out inflation at any cost. Thus, as unemployment rose steadily to double digits, Fed Chairman Paul Volcker kept his foot on the monetary brakes.

Today, the story is decidedly different. Instead of holding the money supply back, the Fed is doing its utmost to boost the amount of money in the economy. As resource inflation rises, the Fed must keep the pedal to the metal to avoid throwing the economy into another sharp downturn. Providing all the money it can ensures that rising resource prices become ingrained in the economy. Unlike the 1970s, today’s monumental gap between financial and tangible assets won’t lead to a less inflationary world. Thus, the worst long-term investments in the early 1980s, inflation hedges are likely to be the best ones today. The Peak Resources & Energy Portfolio is managed around this investment thesis, which aims to protect clients from inflation's perils while producing actual returns.

Investment Strategy Communicated With Transparency

Leeb Capital Management Investment Adviser provides quality investment management services to individuals and institutions. Our steadfast track record began in 1999, with macro “thought leadership” and diligent research wisely guiding our investment portfolio management.

Communication is the key to successful client relationships.

Every client is held in the highest regard and investment portfolios are tailored to meet each client’s investment objectives.

Feel free to request a portfolio review to discuss performance.