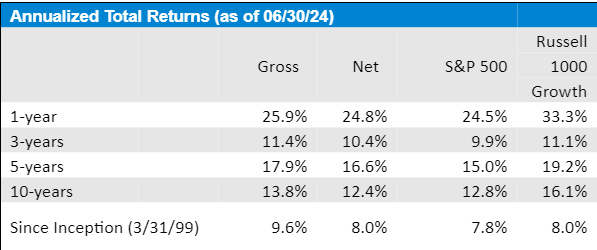

Leeb Capital Management Investment Adviser Performance:

Leeb Capital Management Investment Adviser (“LCM”) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared this report in compliance with the GIPS Standards. LCM has been independently verified from 4/1/99 - 12/31/22Verification assesses whether (1) the firm has complied with all the composite construction requirements of the GIPS standards on a firm-wide basis and (2) the firm’s policies and procedures are designed to calculate and present performance in compliance with the GIPS standards. The Large-Cap Growth The verification reports are available upon request. Verification does not ensure the accuracy of any specific GIPS report.

A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification ensures whether the firm’s policies and procedures related to composite and pooled fund maintenance and the calculation, presentation, and distribution of performance have been designed in compliance with the GIPS standards implemented on a firm-wide basis. Verification does not assure the accuracy of any specific performance report.

*Composite figures from January 2024 through June 30, 2024 have not yet been independently verified.

Past performance is not indicative of future returns.

For more information on performance as well as additional disclosures, contact:

Scott Chan: schan@leeb.com

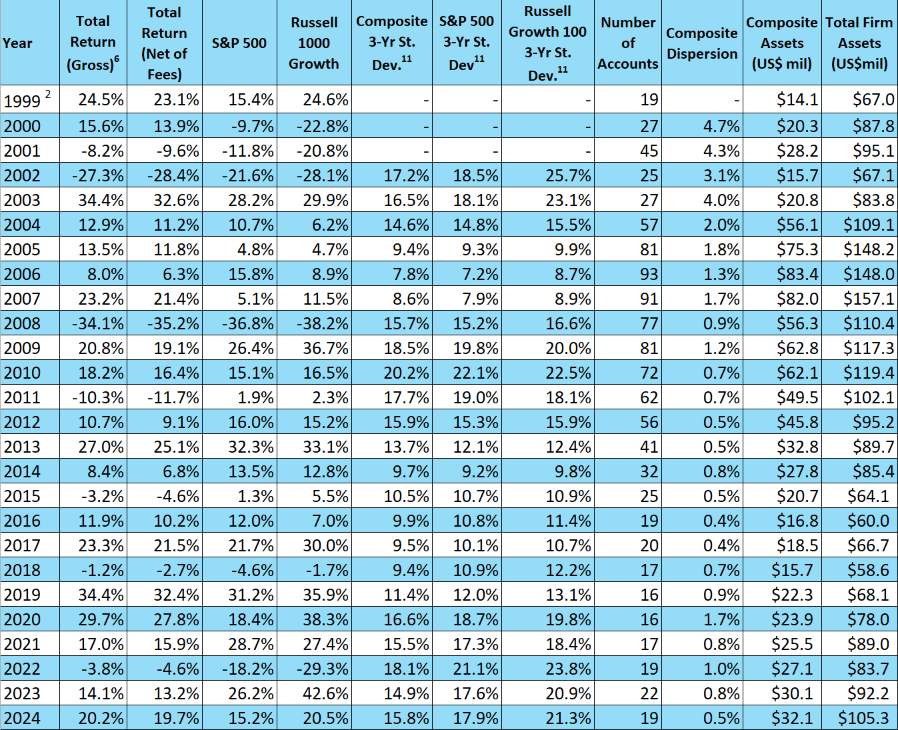

Large-Cap Growth Composite Global Investment Performance Standards Report

Leeb Capital Management (“LCM”) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared this report in compliance with the GIPS Standards. LCM has been independently verified for the periods 4/1/99 through 12/31/23. The verification report(s) are available upon request.

A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report.

Leeb Capital Management (“LCM”) is a registered investment advisor with the Securities and Exchange Commission. Prior to 2001, the firm was doing business as Money Growth Institute. Leeb Capital Management provides equity money management to retail and institutional investors. LCM’s Large Cap Growth Composite (“Composite”) represents all fee- paying accounts with assets greater than $250,000 that are managed in accordance with LCM’s Large Cap Growth (“LCG”) investment strategy. This strategy invests in equities that are managed with a view towards growth, capital appreciation and preservation of capital. The two major tenets of LCM’s Growth investment strategy include the selection of stocks within sectors whose projected growth is higher relative to that of the market, and those stocks which are more cheaply valued than the market on a PEG basis.

The Composite was created on March 31, 1999 which coincides with the inception of this strategy. A complete list of composite descriptions is available upon request. For the periods from April 1, 1999 through September 30, 2007, LCM was verified by Ashland Partners and Company LLP. For the periods from October 1, 2007 through December 31, 2016, LCM was verified by ACA Performance Services, LLC. From 2017 through 2023, LCM was verified by The Spaulding Group. A copy of the verification report is available upon request. Additional information regarding the firm’s policies and procedures for valuing portfolios, calculating and reporting performance results as well as preparing GIPS reports are available upon request.

The composite returns are compared to the S&P 500 Index and the Russell 1000 Growth Indices, the volatility and holdings of which may be materially different from that of the composite. The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market; this index includes a representative sample of 500 leading companies in leading industries of the U.S economy. The Russell 1000 Growth Index is widely used by institutional investors as a gauge of the U.S. large-cap growth equity market. From composite inception, SPDR S&P 500 ETF (SPY) has been used as proxy for the S&P 500 Index. Beginning in January 2001, the iShares Russell 1000 Growth ETF (IWF) has been used as proxy for the Russell 1000 Growth Index. The dates were chosen because they were the first full month for which return data for said ETFs were available at their inception. The ETFs are used because the benchmark indices themselves are not tradeable and LCM believes the ETFs that track these indices better reflect the actual returns an investor could achieve.

Valuations are computed and performance is reported in U.S. dollars.

Since September 30, 2007, the composite gross total returns are presented gross of fees (net of only transaction costs) and includes reinvestment of dividend and income when applicable. Between July 1, 2002 and September 30, 2007, certain accounts paid a bundled fee. For these accounts, the gross return was reduced by the bundled fee (see Note #6). Therefore, for this period the gross returns presented are hybrid returns consisting of both gross-of-fees return and pure-gross return, and are shown as supplemental information. Net return reduces the gross return by investment advisory fees. From composite inception through December 2020, the net return was calculated using the highest management fee (1.5%) charged to clients in accordance with LCM’s Growth strategy fee schedule which is stated below. LCM’s advisory fee schedule is: for Retail Growth Accounts: Up to $500,000, 1.5% flat fee based on AUM; Over $500,000, 1.0% flat fee based on AUM. In addition, between July 1, 2002 and September 30, 2007, the net return for certain accounts was further reduced by a bundled fee (See Note #6). To calculate the net return, the composite’s gross return each month was reduced by 1/12 of the 1.5% annual fee. Accounts in the composite do not pay a commission on trades of most U.S.-listed securities. Beginning in January 2021, the net fee calculation is done using the actual fee paid by accounts in the composite.

Between July 1, 2002 and September 30, 2007, some accounts in the Large Cap Growth composite paid an all-inclusive fee based on a percentage of assets under management. Gross and net performance for these accounts has been reduced by the entire bundled fee. Other than brokerage commissions, this fee includes portfolio monitoring and consulting services (none of which are paid to LCM). As of September 30, 2007, the composite has been redefined to exclude these bundled fee accounts. The percentage of composite assets that were bundled fee accounts, from 2002-2006, respectively, were: 14%, 17%, 7%, 7%, and 6%.

Annual rates of return for the portfolio are computed by compounding the monthly rates of return over the applicable number of months.

LCM utilizes neither leverage nor derivative investments as a material component of its investment strategies.

From composite inception through December 31, 2017, composite dispersion was calculated using the asset-weighted standard deviation of all portfolios that were included in the composite for the entire year. From January 1, 2018 through June 30, 2024, composite dispersion is calculated using the equally-weighted standard deviation of all portfolios that were included in the composite for the entire year. Dispersion is calculated gross of fees.

LCM defines a significant cash flow as an external flow of cash or securities (capital additions or withdrawals) that is client-initiated. An external flow of at least 10% of the portfolio market value is considered significant. This policy became effective July 1, 2002.

The 3-year annualized standard deviation measures the variability of the (gross) composite and the benchmark returns over the preceding 36-month period.

Actual performance of client accounts may differ substantially.

Past performance is not indicative of future results.

The Benchmark Returns are not covered by the report of independent verifiers.

GIPS® is a registered trademark of the CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

The content presented in this document is meant for informational purposes only and should not be used as a recommendation to buy any individual securities. Standard & Poor’s, Russell, and Orion Advisor provided index returns in the performance comparisons. All of this information comes from sources believed by LCM to be reliable. LCM, however, cannot guarantee the accuracy of the comparative returns and, therefore, shall not be held liable for inaccurate information obtained from data providers.

Investment Strategy Communicated With Transparency

Leeb Capital Management Investment Adviser provides quality investment management services to individuals and institutions. Our steadfast track record began in 1999, with macro “thought leadership” and diligent research wisely guiding our investment portfolio management.

Communication is the key to successful client relationships.

Every client is held in the highest regard and investment portfolios are tailored to meet each client’s investment objectives.

Feel free to request a portfolio review to discuss performance.